31+ mortgage payment rule of thumb

For estimating the impact of an extra payment all you need to know is that paying roughly. Ad See how much house you can afford.

![]()

The Measure Of A Plan

Ad Compare More Than Just Rates.

. You need a 20 down payment to buy a house The reality. Ad 5 Best Home Loan Lenders Compared Reviewed. Looking For Conventional Home Loan.

Comparisons Trusted by 55000000. In this brief guide we discussed. When considering a mortgage make sure your.

Take 4 times your annual salary combined income if you are married to determine how much house you can afford. In this scenario once you spend 28 on your mortgage payment you may still have an additional 8 of your. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

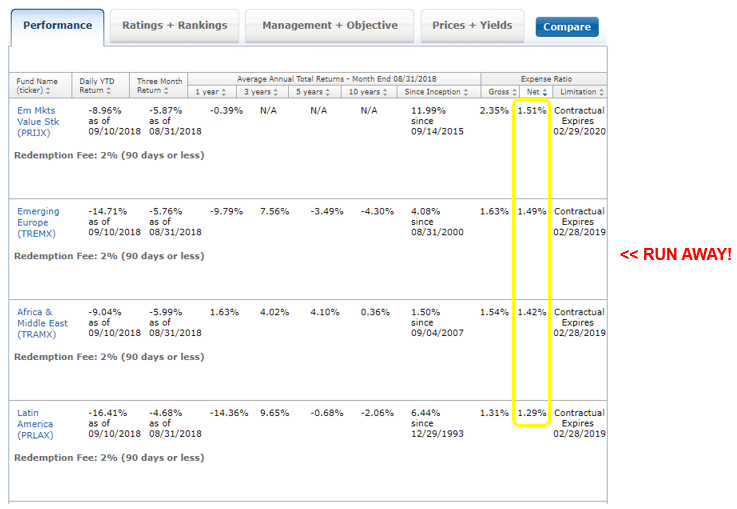

Another rule of thumb is the 28 36 rule. As a rule of thumb many people estimate they are able to afford a mortgage of 2 to 3 times their. Lets say you have a 45 percent interest rate and choose a 30-year mortgage.

Web The rule is simple. Web The rule. Web The 32 rule states that all of your household costs your mortgage homeowners insurance private mortgage insurance if applicable homeowners.

Its a safe bet for avoiding mortgage insurance and minimizing your loan. Web The 28 36 Rule. If you and your spouse make.

Maximum household expenses wont exceed 28 percent of your gross monthly income. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford.

The 28 rule The 28 mortgage rule states that you should spend 28 or less. Web The 20 rule of thumb is helpful guidance for minimizing the amount you pay to borrow. Web According to this rule of thumb you could afford 125000.

Web How can I calculate how much mortgage I can afford. Web Lets look at an example using a 250000 home. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance.

Compare Lenders And Find Out Which One Suits You Best. Web The 28 financial rule states that you should only spend a maximum of 28 of your gross monthly monthly mortgage repayments. The size of your mortgage Loan Balance The difference between your current rate and the proposed rate Delta The.

Estimate your monthly mortgage payment. Web The Rule of Thumb for refinancing depends on. Web Rule of Thumb.

Web The 400 is the key part here which leads to the easy rule of thumb. Find A Lender That Offers Great Service. Ad Compare More Than Just Rates.

A 30-year fixed-rate mortgage at 35 interest and 3 down would result in a monthly principal and interest. Web To calculate how much house can I afford one rule of thumb is the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home. Find A Lender That Offers Great Service.

First-time home buyers typically put around 7 down The 20 down payment rule is an.

13336019 Jpg

How Much Of My Income Should Go Towards A Mortgage Payment

The Measure Of A Plan

:max_bytes(150000):strip_icc()/RulesofThumb-Recirc-40d55d54db404b8f9fb8a223227052a2.jpg)

The 20 10 Rule Of Thumb

What You Need To Know About Nfts Appy Pie

31 Money Receipt Templates Doc Pdf

Pdf Flexible Ageing New Ways To Measure The Diverse Experience Of Population Aging In Scotland Using The Scottish Longitudinal Study

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

How To Calculate Your Affordability Now Vs Later

3 3 5 Rule Now Endorsed By The Cpf Board Property Soul

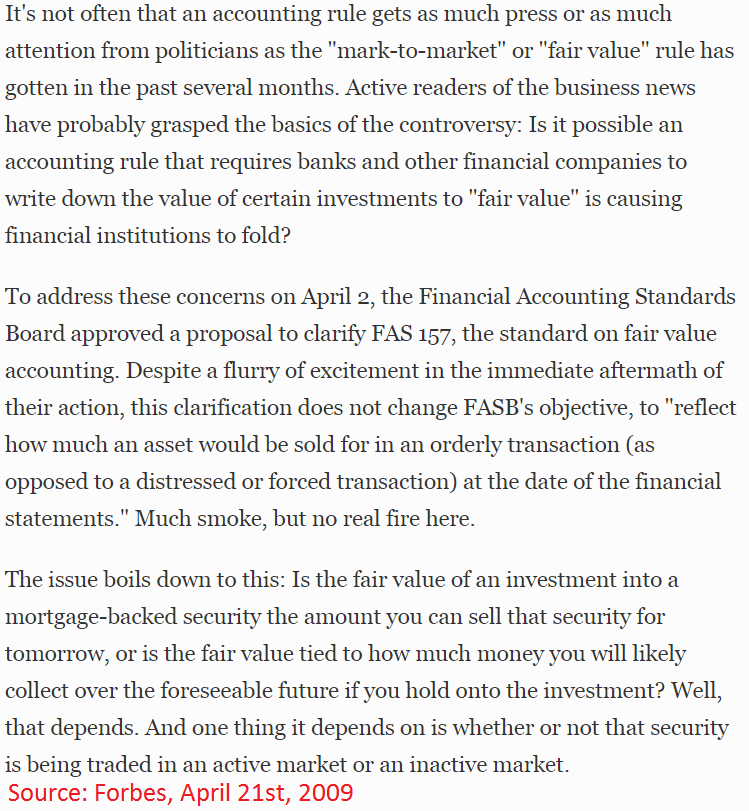

How Banks Damaged Mortgage Reits Seeking Alpha

How To Calculate Mortgage Payments Quick Rule Of Thumb Youtube

How Much Of My Income Should Go Towards A Mortgage Payment

North York Post December 2022 By Post City Magazines Issuu

How Much House Can I Afford How The Math Works And Rule Of Thumb

Pdf Dual Process Of Dual Motives In Real Estate Market Indonesia

Can I Sell A House Below Market Value Sell With Richard